Comprehensive management of housing savings accounts and loans.

SLC system provides comprehensive management of home savings activities with mutual satisfaction of clients and financial enterprises. The system covers end to end process starting with sales support activity, including savings – and crediting process that ends with contract closings.

Characteristics

Purpose

Primary goal of SLC is to support branch network and on-line operation that considers individual set-up of single financial enterprises. Besides expectations resulting from operational environment and business stratetegy are taken into account too.

Market position

Out of the four Hungarian home saving banks SLC operates as a market leader service provider in two home saving banks. Based on modern technology that is in line with industry standards, SLC provides problem free and quick operation of business processes.

Scope

SLC is not only a business application. It offers a stable and reliable business solution due to professional experts and developers of Vemsoft in the background. We do provide efficient and quick solutions, continuous business and IT support to satisfy our customers.

Modules

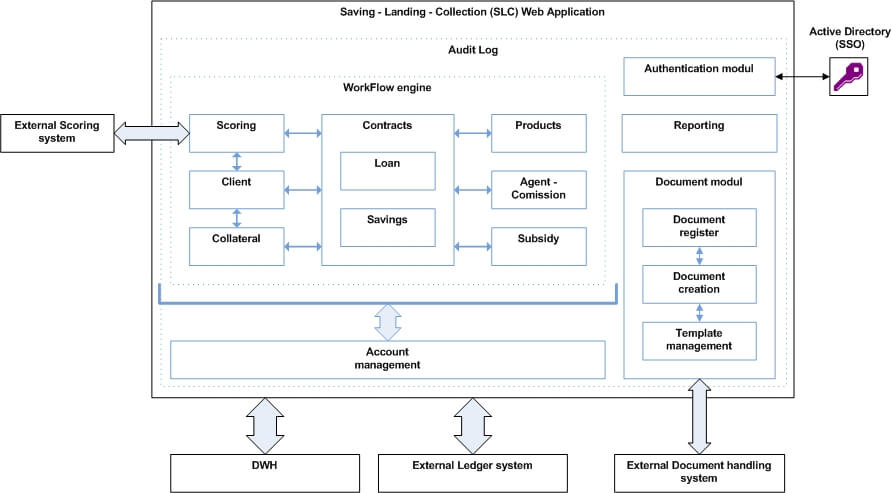

The modular system of SLC flexibly fits into the local infrastructure.

Available moduls are as follows:

- MDM (master data management): ensures that customer, collateral and product data are entered only once and they are available with the same content independently from the place of usage within the system.

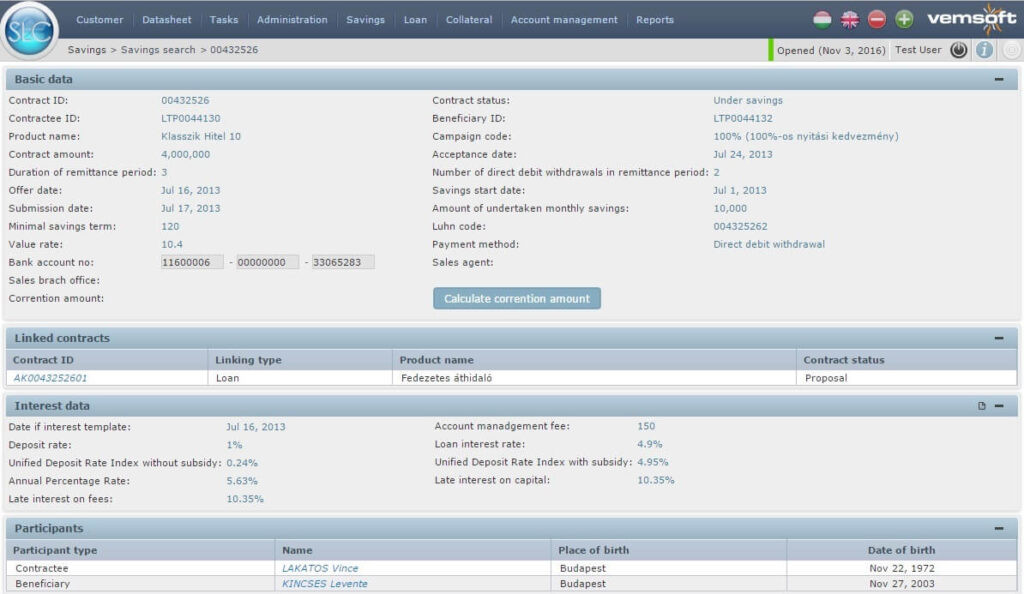

- Contract management: savings and related loan data are available on single sheets/files in a transparent structure that supports efficient daily usage.

- Settlement of subsidies: in accordance with effective regulations reports and settlements are created in connection with state subsidies.

- Scoring: Supports automatic qualification of customers and hereby the whole credit decision making process – scoring is linked to demografic features and can be parameterised.

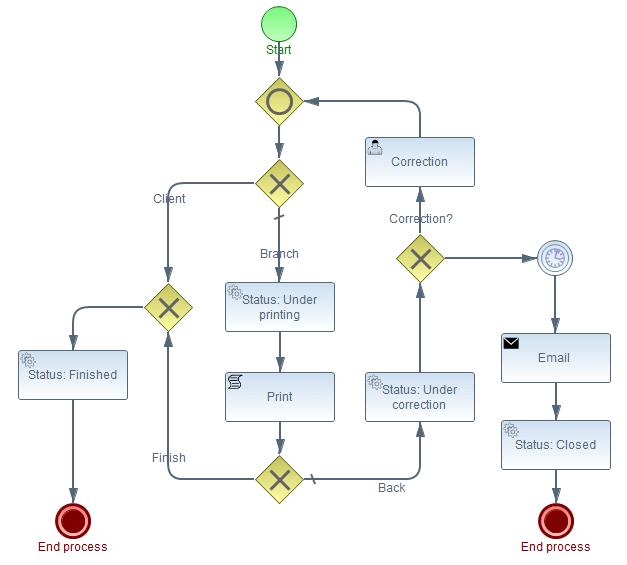

- Workflow: Tasks are assigned to user’s acivity list in accordance with users roles and by considering of local processes.

- Account keeping: SOD, EOD, GL analytics, inventory, value date booking.

- Commission: Agent registry, commission settlement (generation, retrieval).

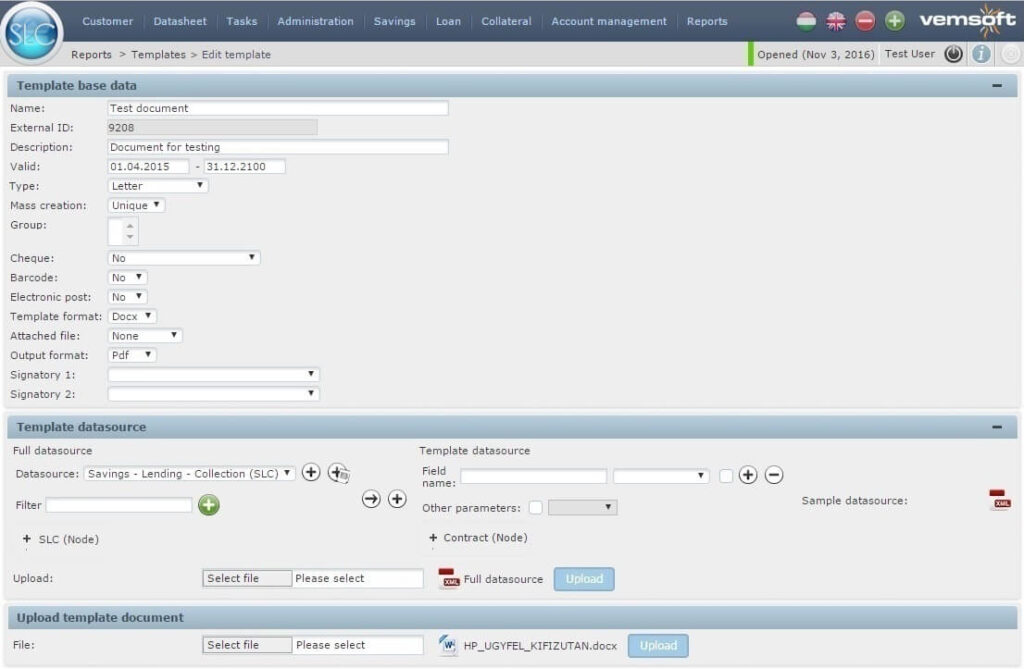

- Document management: support of documents with variable data content by automatic upload from document templates or Excel tables. Created documents can be PDF, Word, Excel, Power Point or html format.

- Collections: Comprehensive support of soft and hard collection that includes up-to-date portfolio data, collection processes set by the user in advance, built-in automatism, further modelling options and reports about achieved results.

- Parametarisation: due to recordings of data groups based on four-eyes principle it ensures recording of numerical data of products, hereby improving efficiency of the function.

- Wide range of Interface technologies (MQ, WebServices, DbLink, File, etc.).

Technology

The applied three layer technology ensures operation safety; Oracle ensures database transparency and platform Java ensures structured layers.

- WebLogic Server 12c R1

- IBM WebSphere Application Server v8.0

- JBoss AS 6.1.0.Final

- Oracle Database 11g R2

References

- Aegon Magyarország Lakástakarékpénztár Zrt.

- Erste Bank Hungary Nyrt.